AR: Funding

AR: Funding

[Note: Posts with titles that begin with “AR:“ are stubs for the project described at “America Reborn,” which probably should be read first…]

How best should the various levels of necessary government be allowed to fund themselves?

Lets start with the premise that government does not fund itself. I know it may seem like semantics but it’s an important distinction. Government must ALWAYS be funded by the governed. Crossing over to my comment in “AR: Sovereignty” since the top tier of government has concern for only the next tier downs sovereign rights it is only that tier that should have responsibility to provide funding for a top tier governments duties. Those duties being limited and defined it shouldn’t be difficult to come up with a formula based on population and territory to make each lower tiers responsibilities equitable. For this discussion I’m simply focusing on top level government. We can drill down to the funding of lower tier government later. For now to me it’s important that the top tier government should have no income stream that doesn’t pass through the sovereign lower tiers. Any new government should examine 1913 only from the perspective of looking down into the ash bin of history.

A balanced budget mandate is a necessity as well as a commodity based currency. Any borrowing should be for only the most extreme needs such as natural disaster or war. Every dollar when borrowed must be amortized to be paid back without the ability to “refinance” or borrow to pay back. The Amortization should be calculated so that no less than 30% of any payment pays down principal.

I favor the so-called “Fair Tax”, a tax on consumption. However, I would modify the current Fair Tax proposal such that nobody ends up totally exempt from paying some portion of the total tax collected. The intent here being to dampen the “something for nothing” aspect of the current system that encourages citizens to vote themselves benefits from the public treasury.

IMHO, income taxes, corporate taxes and payroll taxes should be banned by the new constitution.

No tax can ever be totally equitable but the Fair Tax, in my reasoning, comes closer than any other method I am aware of.

I do not favor a balanced budget amendment because such presumes we can predict the future. What I do favor is a constitutional requirement that each year’s tax rate be calculated to produce revenue in the amount of 110% of the previous year’s spending. WTS should have the right and the ability to vote for whatever benefits we want from government, whether directly or through our elected representatives. However, the taxes to pay for said benefits must be unavoidable and timely.

Troy

100% agreed on the “fair tax” proposal. Put the governments sole interest in facilitating economic activity (Like individuals it’s funding depends on it) while at the same time allowing an individual a measure of control over their level of taxation. I would submit that any commerce tax or “fair tax” paid directly by the people be calculated and collected only by the state. The level of taxation determined by the state to cover both state expenses as well as their apportioned support of the federal government.

Agreed. Everyone should have “skin in the game” even if only a token amount. Possibly with the exception of retirees who have been skinned their whole lives and the legitimately disabled. Still they could be taxed on spending above the baseline.

Here’s where I have to disagree Troy. Your 110% taxation of the previous years expenses is to close to a very real problem the current federal government has. Baseline budgeting. If you give them the money they are going to spend it. It would in effect cause a 10% annual budget increase. The current federal government would even salivate over that kind of expansion.

As I said in my original comment a BBA doesn’t preclude borrowing in emergency. That borrowing just has to be structured in a fashion that repayment of that debt becomes part of subsequent budgets with a mandatory sunset of principal on an individual loan or “bond bill”. That would force the level of taxation to increase proportional to the level of borrowing and at a certain point would cause people to “put on the brakes”. Right now people get the benefit of borrowing without any repayment responsibility. Under the fair tax when the price of a car goes up 5% because the government gave a couple million people an iphone last year somebody might take notice.

That said overall I think we have a good start here.

Chris, I base my proposal on the notion that the people have the right to petition their legislature for whatever they wish — just as the do now. My difference is that whatever “goodies” they ask for today will certainly be paid for tomorrow. And, if you think the people will stand for an annual 10% tax increase, you are sadly mistaken.

A proposal I find particularly obnoxious is the one mandating a balanced budget except in time of war. Is there a better excuse for perpetual war?

Troy

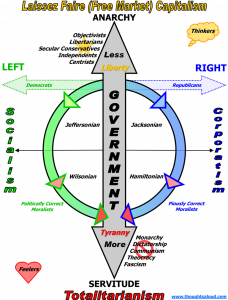

No one seems interested in answering my fundamental question regarding “Purpose,” so what I had expected to be an enjoyable intellectual exercise appears to have stalled. Effectively precluded from suggesting positive ideas for establishing a laissez faire stateless society for America 2.0, I suppose I am relegated to critiquing those ideas of others, preferring (or at least convinced that civilized society must have) rulers to control the sheeple.

As to funding, my approach would have been simply to replace all government functions with private enterprise, which would be voluntarily supported, by willing customers paying for their services. If you insist on having a state, and empowering it to confiscate involuntary taxes from unwilling citizens, then some of the ideas expressed above seem less than ideal.

Why ever for? Couldn’t you design a seriously limited government that wasn’t a welfare state? Our original Founders certainly did. Must the sheeple of Florida be given the power to petition for hurricane relief, which the citizens of California must then be taxed to provide? Explain why a nation state would ever need to provide its constituents more than national defense and a court system for adjudicating disputes between them?

While I take the point on the occasional need to borrow for unexpected contingencies, the rulers should not be permitted to inflate the currency with their printing presses. Inflation is the most insidious and cruel tax of all. See: “Money”

I have always liked the “Fair Tax” as a potential replacement for the current revenue system; but if we were starting over, I would advise against it. First, the idea of sending a check to low-income citizens to offset it, would be ridiculous and a nightmare to administer. Further, while the idea of taxing consumption rather than income makes a lot of sense, it would be even more of an onerous bureaucratic mess to collect, than income taxes are now.

Forcing businesses to do the tax collecting for the rulers is always problematic, and the higher sales taxes go, the more lucrative participation in the black market becomes. I have always found it rather easy to avoid paying sales tax on cash purchases. If, as suggested, each level of government is funded by billing its constituent parts, how in the world would the online market ever be effectively taxed by the lowest level, to pay their assessments to the next higher level? If local businesses think competing with the internet is difficult now, wait until they are required to collect 25+% sales tax!

What about the insidious hidden taxes, like government regulations, which are all ultimately paid by consumers?

It would seem to me that the simplest and fairest method of funding the rulers, would be the same one used by our Founders – property taxes. They are unavoidable, because even renters are effectively paying their share in their rent. Using the suggested hierarchical system of governments, all taxes would be collected by the government closest to the people, once or twice a year. Without being able to hide them with all the usual obfuscation, the taxpayers would have to notice how expensive their government actually was, and perhaps be motivated to keep them somewhat under control. â—„Daveâ–º