Money

Money

In a discussion below, there was a question regarding whether we should go back on the gold standard. We more or less already are on a gold standard, when it comes to international trade. First, let’s get some of our terms defined, to avoid sloppy thinking and miscommunication. Money, currency, note, dollar, $, ¢, wealth, and capital, are all distinctly different terms for very different concepts, yet people often conflate many of them in their minds and discourse.

- Money is a tangible, durable, commodity, used as a medium of exchange between traders, and/or a storehouse for wealth. It must have intrinsic value itself (desirable and useful for other purposes) to be real money, or a value for value exchange could not be completed. Any commodity could be used for money, and all manner of desirable things have been so employed over the ages. It just happens that gold and silver have always been popular, because of their utility, durability, and scarcity, which maintains a consistent high value on a small quantity of either.

- Currency is a token representing the concept of money, which is employed as a convenient interim medium of exchange, when completing the trade with actual money, is inconvenient or impossible. It has no intrinsic value itself; it is merely a slip of paper, ledger entry, or digital representation of the concept of money. Accepting currency in exchange for something of value, represents an unfinished exchange. Not until this interim currency is traded again, at some future time for something tangible, is the value for value exchange completed. A prudent seller only ever accepts as currency, tokens he is reasonably sure will be readily accepted by traders in the future, in exchange for something he deems of equal value, to complete the trade.

- Note is a legal term for an instrument of debt, such as a promissory note or an IOU. It is a promise to deliver a value at some (often indeterminate) future date. It can be used as currency, only to the extent that one is convinced that future traders will accept it in turn, in exchange for something of actual value. It is far riskier as currency, than is a ‘deposit certificate,’ guaranteeing immediate conversion to real money, to the bearer on demand, at the depository (bank).

- Dollar is a term for a unit of measurement, akin to cup, quart, gallon, etc. It is entirely correct to speak of a dollar of beans or a dollar of nails. When offered a number of dollars [or quarts] in exchange for a value, the proper response ought to be, “A dollar [or quart] of what?” In America, the quantity of wealth assigned to this measurement is established by Congress, in relation to gold or silver money. Originally, one U.S. Dollar was established as the equivalent of one ounce of silver or 1/20th of an ounce of gold. Thus, a dollar of donuts, is the quantity of donuts a baker would be willing to trade, for one ounce of silver money; but it would be entirely legitimate to offer to trade a dollar of rice for them.

- $ & ¢ are symbols that once represented a finite quantity of money; but they have devolved to now represent highly fluctuating quantities of fiat currency. $ represents one unit of Federal Reserve currency in circulation, and ¢ represents 1/100 of said unit. Due to the frequent devaluing of this currency, by the deliberate inflation of its quantity in circulation, any relationship these symbols have to current values or prices is highly transitory, and not to be depended on for future planning.

- Wealth is tangible evidence of past production and/or labor expended, beyond that necessary for immediate survival. Property and money are forms of wealth; currency is not. Debt-based currency is at best, a precarious claim on future wealth.

- Capital is previously produced wealth, available to be employed in the production of more wealth.

Before a foreign businessman accepts Federal Reserve notes (which are nothing but irredeemable IOU’s from a foreign country to him), in exchange for something of actual value he is selling, he must determine for himself what value he places on these little green slips of paper. While they may very well be more stable and convertible in international trade, than his own country’s fiat currency (and perhaps worth hording for that purpose) he can’t eat them and didn’t produce his products to trade for stacks of worthless paper. At some point he will desire to complete his trade, by spending them for something of actual value.

As an international trader, he is keenly aware that the relative values of various currencies are constantly shifting, and of the steady erosion of the purchasing power of the U.S. Dollar. He is also aware that gold is real money, which has remained remarkably consistent in its purchasing power over the centuries. It only makes sense for him to calculate his cost of production in gold, add his desired profit margin, and establish his price in gold in his own mind. Then, when he quotes his asking price for his products in any currency, the figure will be the amount needed to convert into the requisite amount of gold, in his local market.

Thus, when the Federal Reserve inflates the number of notes it has in circulation, the gold market will automatically rise accordingly, so he will have to raise his $US price for his products, to continue to earn his expected profit. This, more than speculation or any of the other sinister theories about rising oil prices, etc. explains what keeps happening to us. Once an oil producer, for example, has established what is considered a fair price for delivering a barrel of oil, he has every right to expect to continue to earn that amount, regardless of the manipulation of America’s currency. If it costs more $US to buy gold, then it will cost more $US to buy oil; but the producer is not getting richer, he is just maintaining his status quo, earning the same amount of profit as before. The guilty party for rising fuel prices in America is largely the Federal Reserve, not OPEC.

Put your thinking cap on. When I was a junior in high school, I had a part-time job bagging groceries in a supermarket. It was a minimum wage job, paying $1.15 per hour, and by working nights and weekends, I earned about $35 per week. Then, since nearly everyone in Las Vegas worked for tips, pretty ladies would tip me 25 or 50 cents just for loading their bags in their car. Lest any of you young folk feel sorry for me, or think I was being exploited for ‘starvation wages,’ think again. The currency at the time was not IOU’s, but silver-backed deposit certificates, which I could convert at will into real silver coins, at any bank or casino. My paycheck was roughly equivalent to earning an ounce of gold a week ($35).

I was able to afford a brand new car at the age of 16, with a monthly payment of less than $30. Gasoline was about 25 cents a gallon, so with my tips, gas money was never a problem. I could buy a movie ticket, popcorn, and a soda for less than a buck. Instead of any of us getting an ‘allowance,’ I employed my sisters to do my share of the dish-washing and other household chores. I bought my own clothes, school books, haircuts, etc. and still had plenty left over for my savings account. Let’s analyze my income the same way our foreign trader would, in reference to the value of gold, which at the time was fixed by Congress at $35 an oz. (already a 75% devaluation of our fiat currency since our founding).

35/.25=140, so an ounce of gold would buy 140 gallons of gas. Currently gold is around $1,600 and 1600/140=11.42, which means gasoline is about a third as expensive today, as it was then. Another way to look at it, is that at current silver prices, a silver quarter is worth about $9, so nobody ought to be bitching about the price of fuel. In real money terms, it is quite a bargain. It is the value of labor, which has not kept pace with our inflated currency. How many sixteen-year-old box boys (or girls and whatever they call them today) are earning $1,600 a week, driving a new car, and being tipped enough to buy a gallon or two of gas for a single trip to the parking lot?

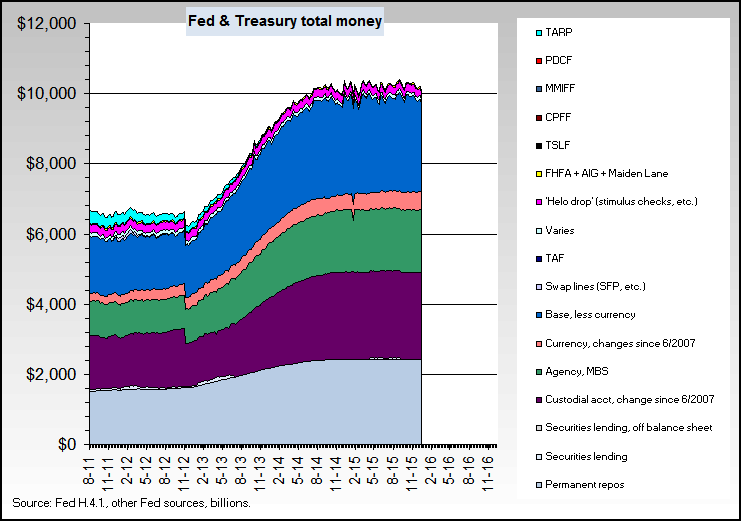

Therein lays our problem. It is not the value of gold, silver, or even oil that has changed. They have remained remarkably consistent throughout history. It is how many green slips of paper they represent, which is constantly changing, and lately at an alarming rate. I have found an interesting source of financial charts. They have worked out a way to reconstruct M3, which the Fed quit reporting about the time they started inflating the money supply like there was no tomorrow. It appears to be updated weekly. There are all manner of charts worth perusing there, and many of them look like Al Gore’s hockey stick; but my favorite is:

It represents all the currency the FED has “printed” lately (although much of it is digital instead of paper). If one looks closely, there was about a trillion dollars in circulation in early 2008 and they quadrupled it by Christmas. They added another trillion in 2009, another by the end of the first quarter of 2011, and the world has been awash in around $6.5 Trillion in U.S. currency since then. Now, they are talking about needing another ‘easing’ of liquidity? Really? We are drowning in their damn liquid already, and the prices we must pay for our daily living are rapidly trying to catch up. The hockey stick that is building now, is the true cost of living.

More importantly, this is just a symptom of a much more serious problem. Every one of our incomes, bank accounts, and investments are rapidly losing buying power, and it isn’t going to stop anytime soon. The Federal Reserve is in crisis mode with the printing presses running 24/7, to try to save the banks and investment firms from total collapse. We ought to buckle up, and bitch as loud as we can; but we should try to focus our rage on the right target. If we blame the oil companies, or foreign competition, we are being duped by the smoke and mirrors of the politicians, at the behest of the central bankers, who are the ones really in charge.

Remember the Golden Rule: “He who has the gold, makes the rules.” The truth is, the current price of gold is still amazingly low, considering the inflation the above chart clearly illuminates. It was around $900 per oz. when that chart begins in the summer of ’08. There is roughly six times as much currency in circulation as there was then, yet gold prices have less than doubled. By rights, it should be 900×6=5,400; that is right, $5K+ per oz. It will get there eventually folks, probably sooner than later. Meanwhile your savings and paper investments are depreciating just as fast. Think about it. â—„Daveâ–º

Very well written. All you said seems rather obvious to me — yet, getting this message across to the masses is virtually impossible.

What a world we live in where millions are willing to live their lives in accordance with the alleged words of an alleged deity that all logic proves cannot possibly exist in the form they suppose while being unwilling to accept simple truths that can be demonstrated using high school math.

Thanks Dave.

BTW, I’m ready for that $5K/oz. My investments in natural gas production are returning squat since we starting virtually giving the stuff away. Why are we erecting giant bird choppers when so much clean energy is so available and so cheap?

Troy

Thanks, Troy. Belief in magic and acceptance of dogma doesn’t require critical thinking, which takes a bit of effort, and I suppose it is comforting. Our refusal to exploit our own natural resources is a form of collective insanity.

My effort at defining my terms here is a direct outgrowth of your earlier lament, which I have been cogitating on. My solution is to create a ‘Terms‘ page, with these as just the first of many definitions which will reside there. I will work on the ‘Education’ section next. Then, we can live link to these terms, when we wish the reader to have access to our connotation for any of them.

I have disabled comments on the page itself, which is linked on the top menu, to keep it clean and useful as a tool; but I am very open to feedback and tweaking any of them, or suggestions for additional entries, which can be discussed in other comment sections. It is going to be a bit of work to flesh it out; but it should pay dividends in the future, by not having to keep explaining what we meant when we used an ambiguous term. What do you think of the idea? â—„Daveâ–º

I never realized that you could do that in terms of “Dollar” before. I take it that you would say that there is no way to do that any longer because the dollar has nothing attached to it (like the Gold Standard?)

As to “Money,” do you think the US Dollar (currency) is no longer “money” (valuable) (probably a gross simplification here, but… question remains :p) due to its quantity?

Now, to contribute something to your terms 🙂

There is something I’d like to say in regards to Group Think. It was one of the psychological concepts I learned in school in a politics class. The example that was used was the Bay of Pigs. To give a little background: The original plan was to drop the rebels (Guerilla forces fighting for us) on one side of the island, they’d fight, and if they needed to, they would trek to the other side of the island and be picked up. The problem with this was that the CIA and everyone else who was planning with it simply went along with the plan…

…Had they stopped for a moment and researched what they were doing, they would have realized there was a swamp in the middle of Cuba! (This is amongst the many, many problems with the Bay of Pigs, but that’s an example of how groupthink can fail you)

I also have a few books I’d recommend for things along those lines:

Blink: The Power of Thinking without Thinking, By Malcolm Gladwell,

and The Inquiring Organization, by Dr. Kikoski (my former professor)

Hope this contributed something to your blog! 🙂

*facepalm* THat should have been this: As to “Money,†do you think the $US (currency) is no longer “money†(valuable) (probably a gross simplification here, but… question remains :p) due to its quantity?

My bad.

Thanks for the book recommendations, Greg. I will look them up. The groupthink example was interesting; but I can think of many more illustrative examples among the partisans in our politics.

No, the Federal Reserve note never was money, it is and always has been debt-based fiat currency. It is fairy dust, with no value whatever. The only reason anyone would accept it in a trade, is the reasonable expectation that they can palm it off on someone else, before it loses very much more buying power. The moment that expectation becomes unreasonable, it will take a wheelbarrow full of them to buy a loaf of bread.

Correct, the term ‘Dollar’ as with the symbol ‘$’ no longer is a measurable quantity, and thus has lost its original meaning. For most sheeple, it is merely a truncated name for a ‘dollar bill,’ which is a little green slip of paper. Postage stamps are actually of greater value. At least they are a promise to perform a service for the bearer; the FRN promises nothing at all. â—„Daveâ–º

And to come full circle with the talk of returning to the “gold” (or something) standard, mentioned elsewhere, the dollar would regain its actual value again. Have I connected these concepts fully? 🙂

It depends on what you mean by ‘dollar,’ Greg; and it would have to accompany the repeal of the Federal Reserve Act, the end of fractional reserve banking, and the abandonment of Keynesian economics. American citizens themselves have been off the gold standard since 1933, when FDR by an unconstitutional executive order, confiscated most privately held gold money in America, replacing it with fiat currency at the rate of $20 per oz. Possessing more than a token amount of gold in this country became a serious felony, which is what started the offshore banking craze. One could deposit as much gold money as desired in a safe, reliable, and discreet Swiss bank account, just not an American one.

Once that was accomplished, the next year he devalued the dollar by 75%, decreeing gold to then be worth $35 per oz. This was a massive rip-off of the American people, and anyone else holding U.S. currency at the time. Only those prudent enough to have retained their real gold money, were unaffected by this plunder. Foreign banks could still redeem their U.S. currency for gold money out of Ft. Knox, but overnight the $US ‘price’ for an oz. of gold went up 75%.

Whoa… I just did a search to confirm what year Charles de Gaulle forced Nixon to end the gold standard, by draining Ft. Knox with inflated dollars (1971) and stumbled across this article, which is well worth reading, and allows me to stop right here. It turns out, there never was a gold standard… 🙂 â—„Daveâ–º

“I can think of many more illustrative examples among the partisans in our politics.”// can you tell me some of them?

There is also the opposite of groupthink, which is a lot of talking a not a lot of actually DECIDING. I actually did a thesis paper in college on the coup in Vietnam. There were two factions in the JFK administration trying to win influence; one said, yes throw the coup, the other, the opposite. They sent a man down to Vietnam named Henry Cabot Lodge (does the name sound familiar to you? 🙂 ) to act as ambassador. While he was there, the cabinet talked…and talked…and talked. Eventually, some of the members in the anti-coup faction left. Yet they still talked and couldn’t make up their mind!

In the meantime, Lodge, in Vietnam, spoke to the rebels and pretty much took matters into his own hands, planning the coup and getting ready for it. In some circles, he would be villain; in others, he would be a hero since he was the only one who made the decisions that needed to be made!

Almost a week before the coup, JFK sent a memo down to Lodge saying “Abort! Abort!” Lodge said, “I do not believe that the US has any authority to stop the rebels from their destiny” (forget the exact words) — in other words, HELL NO!

It is my contention that, to this day, had JFK asserted himself and made a decision rather than just talked and talked, the coup (or non coup had he decided that way) would have turned out much better than it had. Thus, we have the opposite of groupthink: Nobody being able to make a decision–period–and an exchange of ideas that leads absolutely nowhere, the exact opposite you want in a President. I wonder if there is a term for this phenomenon? I will have to investigate 🙂

There is a great old article by Alan Greenspan (pre-Fed days) posted at:

http://tspeak.us/gold-economic-freedom-alan-greenspan/

…which adds much to this discussion. â—„Daveâ–º